Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachel Bodine

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All.

Written by Rachel BodineSchimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach.

Reviewed by Schimri YoyoLicensed Agent & Financial Advisor

UPDATED: Sep 5, 2024

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 5, 2024

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

An auto insurance policy number is a unique identifier that connects you directly to your coverage, essential for efficiently managing claims and billing within the types of auto insurance.

An auto insurance policy number is a unique identifier that links you directly to your insurance coverage, crucial for managing claims and handling billing efficiently.

This number, found on your ID cards, billing statements, and the policy declaration page, serves as a vital tool in streamlining your interactions with insurers. Understanding where to locate and how to use your policy number can significantly ease the process during claims or when updating your policy details.

Insurers utilize this number to customize rates and coverage options according to different criteria, enabling you to receive tailored insurance solutions when you search policy number.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code above to begin.

Things to rememberUnderstanding your car insurance policy is important. Your policy contains an array of elements that make it specific to you. For instance, when you purchase a policy, you select dates, coverages, monetary limits, and applicable auto insurance discounts. These elements influence your monthly rates and the claim filing process, as illustrated in a car insurance number example.

So, what is a policy number for car insurance? Your account policy number is a unique identifier that links you and your coverage directly to the insurance company, functioning much like your social security number.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Where can I find my car insurance policy number? Once you purchase an insurance policy, you will find your policy number in several locations. The most common areas include the declarations page, your auto insurance ID card, and billing invoices.

Your policy number car insurance declarations page outlines the specifics of your policy, including comprehensive auto insurance coverage, and details the monthly and annual rates.

The declarations page is the first page in your auto insurance policy documentation. You’ll likely find the policy number at the very top on the right side.

You can think of this page as a summary of your insurance policy, and refer back to it for your policy number and information on deductibles and coverage.

Every insurance company designs its auto insurance ID cards differently, but there are certain elements you will find on them all. So how does proof of insurance look? These elements include:

Your car insurance policy card should be mailed to you shortly after you purchase a policy, although you can access it online right away. This availability prompts the question of where should you keep your auto insurance cards to ensure they are both secure and accessible.

Whenever you receive an invoice or mailer from your insurance company, your policy number will be prominently displayed at the top, including on invoices for your monthly policy rate, which are auto insurance usually billed a month in advance. You also have the option to go paperless and receive your bills via email.

You may be asking, “How many digits is a policy number?” Every insurance company creates its own policy identifier method. Larger companies with more policyholders may need more digits to accommodate all the policies.

Understanding your auto insurance policy number is key to streamlining claims and managing your coverage efficiently.

Laura Berry Former Licensed Insurance Producer

Some insurers use a sophisticated system that incorporates coding into the policy number, employing a combination of numbers and letters that may appear random but carry distinct significance for the insurer, known as the auto retention number. This tailored sequence is crucial in identifying the auto insurance policyholder.

Unless you are well-versed in the policy number guidelines of most policy numbers for insurance companies, you will find it challenging to identify a company by someone’s policy number. Sometimes companies use letters at the beginning of the policy number to identify the state of issuance, but the numbers that follow represent the policyholder more than the company.

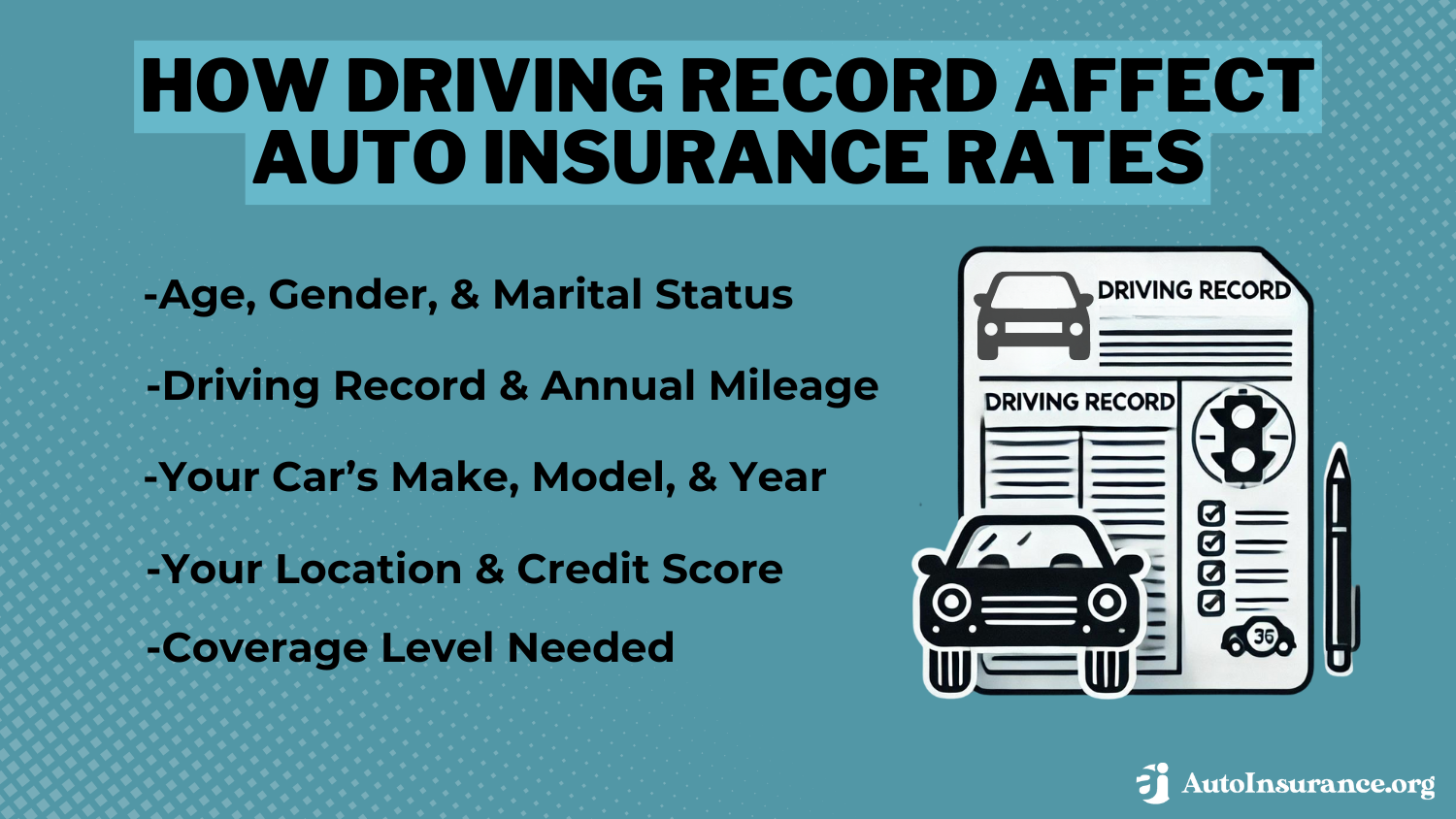

Auto insurance policy numbers are shaped by numerous factors that directly impact the auto insurance premium and coverage specifics. Elements such as the driver’s age and the vehicle type insured are crucial in defining the details of your insurance policy.

Auto Insurance Policy Numbers Factors| Factor | Description | Impact |

|---|---|---|

| Age | The age of the insured driver | Younger drivers (under 25) typically have higher insurance rates due to inexperience, which can affect their policy terms and rates |

| Annual Premium | The total yearly cost of the insurance policy | The amount you pay annually influences the specific policy structure and number, particularly if paid in full versus monthly payments |

| Coverage Level | The amount of coverage chosen (liability, comprehensive, collision, etc.) | Higher coverage limits lead to higher premiums, while basic coverage can result in lower costs and different policy numbers |

| Credit Score | The credit score of the insured driver | In some states, a higher credit score can result in lower premiums, while lower credit scores may increase the cost of insurance |

| Discounts | Available discounts (e.g., good student, multi-policy, safe driver) | Discounts can reduce premiums and may be reflected in specific policy numbers or coverage plans |

| Driving Record | History of traffic violations, accidents, and claims | A clean driving record can lead to lower premiums, while accidents and violations can increase policy costs and influence coverage limits |

| Gender | The gender of the insured driver | Males, particularly young males, may have higher premiums due to higher accident risk compared to females in certain age groups |

| Location | The ZIP code or state where the vehicle is registered and driven | Urban areas with higher crime rates or traffic congestion can increase premiums compared to rural areas |

| Marital Status | The marital status of the insured driver (single, married, etc.) | Married drivers often receive lower premiums compared to single drivers, as they are considered less risky |

| Mileage Driven | The average number of miles driven annually | Low mileage can lead to discounts, while high mileage may increase the risk profile, impacting the policy details |

| Vehicle Safety Features | Installed safety features like airbags, anti-theft systems, or collision avoidance systems | Cars with advanced safety features can receive discounts, affecting both premiums and the structure of the policy |

| Vehicle Type | The make, model, and year of the insured vehicle | High-performance or luxury cars typically result in higher premiums, impacting the overall insurance policy and coverage options |

Understanding the car insurance policy format and the factors that influence policy numbers and costs simplifies navigating the complexities of auto insurance. By considering these elements, you can customize your coverage to fit your needs and potentially secure lower premiums.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Are policy number and VIN number the same? No, your VIN and car insurance policy are different.

Every auto manufacturer assigns a vehicle identification number to each vehicle produced. It acts as a code that explicitly represents the vehicle. You’ll find the VIN for your vehicle under the windshield, typically on the driver’s side. It contains 17 numbers and letters with specific meanings:

While you must provide this number when purchasing a policy, it is not the same as a policy number.

The important takeaway is that your VIN will never be your policy number, but your insurance account number and policy number may be the same, depending on the company.

When buying an auto insurance policy, you must provide sensitive information, including your social security and bank details. Some insurers use an account number to keep this personal data separate from your policy information, while others use your policy number for all identification. This raises the question: does your car need to be registered to get auto insurance?

If you experience a car accident, one of the first things you do is exchange insurance information with the other party. In no-fault states, you will file a car insurance claim with your insurance company to recover damages, regardless of who is responsible for the accident.

However, most states adhere to the at-fault policy. In that case, you use the other party’s policy number to file a claim with their insurance company. Either way, you need the policy number to access the coverage and receive compensation.

Every insurance company provides online access to detailed information about your auto policy number. By becoming familiar with your insurer’s website, you can easily access your coverage details and policy number, facilitating how to get free online auto insurance quotes.

You can use the website to file claims, make policy changes, and access your car insurance ID cards. Many companies offer an app that you can install on your smartphone, allowing you to print your ID card or save a digital copy of your car insurance ID number on your phone.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Have you ever wondered, “What is the account number on insurance card?” That number identifies your individual policy so your insurance company can verify that it is servicing the right policy.

Now if you’re asking, “does the insurance policy number on my card make affordable auto insurance available?” If you have a excellent driving record, it can as your insurance policy can run a check on your policy and confirm if you are eligible for certain discounts.

What is an insurance policy number? It is a unique identifier assigned to policyholders to track coverage and claims. Each Progressive driver, for instance, has a distinct Progressive policy number. How many numbers are in a policy number? Typically, your car insurance policy number is a string of 8 to 10 digits on your insurance card. For example: 12345678.

When insuring multiple vehicles, you may notice identical numbers on the insurance cards for each car, or minor variations such as 12345678-1 and 12345678-2. This facilitates your insurance company in pinpointing the specific vehicle tied to your query, enhancing communication through auto insurance policy number lookup.

On your insurance card, the long sequence of numbers you see represents the vehicle identification number (VIN), not the policy number, which can be identified through an auto policy number lookup. The VIN, comprising 16 alphanumeric characters, uniquely identifies your vehicle and is crucial for determining auto insurance rates by vehicle make and model.

Your insurance policy number is essential in scenarios such as accidents, where you must exchange details with other drivers or provide them to the police, and during police stops, where showing proof of insurance is required. This is important to know, especially when considering how long an accident stays on your record.

Despite state registries tracking insurance, they may not always be accurate, making it necessary to keep your insurance card accessible at all times. If you’re in need of an incentive to avoid driving without insurance, just take a look at the consequences that can come with such a charge in your state:

Driving Without Auto Insurance by State & Offense| State | First Offense | Second Offense |

|---|---|---|

| Alabama | Fine: Up to $500; registration suspension with $200 reinstatement fee | Fine: Up to $1,000 and/or six-month license suspension; $400 reinstatement fee with four-month registration suspension |

| Alaska | License suspension for 90 days | License suspension for one year |

| Arizona | Fine: $500 (or more); license/registration/license plate suspension for three months | Fine: $750 (or more within 36 months); license/registration/license plate suspension for six months |

| Arkansas | Fine: $50 to $250; suspended registration/no plates until proof of coverage plus $20 reinstatement fee; the court may order impoundment | Fine: $250 to $500 fine — minimum fine mandatory; suspended registration/no plates until proof of coverage plus $20 reinstatement fee. The court may order the car to be impounded |

| California | Fine: $100-$200 plus penalty assessments. The court may order the car to be impounded | Fine: $200-$500 within three years plus penalty assessments. The court may order the car to be impounded |

| Colorado | Fine: $500 minimum fine; 4 points against your license; license suspension until you can show proof to the DMV that you are insured. The courts may add up to 40 hours of community service | $1,000 minimum fine, and a license suspension for four months, four points against your license. The courts may add up to 40 hours of community service |

| Connecticut | Fine: $100-$1000; suspended registration/license for one month (show proof of insurance) with $175 reinstatement fee | Fine: $100-$1000; suspended registration/license for six months (show proof of insurance) with $175 reinstatement fee |

| Delaware | Fine: $1500 minimum fine; license/privilege suspension for six months | Fine: $3000 minimum fine within three years; license/privilege suspension for six months |

| Florida | Suspension of license and registration until reinstatement fee is paid and non-cancelable coverage is secured; $150 fee for first reinstatement | Suspension of license and registration until reinstatement fee is paid and non-cancelable coverage is secured; $250 fee for the second reinstatement |

| Georgia | Suspended registration with a $25 lapse fee and a $60 reinstatement fee. Pay any other registration fees and vehicle ad valorem taxes due | Within five years: Suspended registration with a $25 lapse fee and $60 reinstatement fee. Pay any other registration fees and vehicle ad valorem taxes due |

| Hawaii | $500 fine or community service granted by a judge. Either license suspension for three months or a required non-refundable insurance policy in force for six months | Fine: $1500 minimum fine within five years; either license suspension for one year or a required non-refundable insurance policy in force for six months |

| Idaho | Fine: $75; license suspension until financial proof. No reinstatement fee. | Fine: $1000 maximum fine within five years and/or no more than six months in jail; license suspension until financial proof. No reinstatement fee. |

| Illinois | License plate suspension until $100 reinstatement fee and insurance proof | License plate suspension for four months; $100 reinstatement fee and insurance proof |

| Indiana | License/registration suspension for 90 days to one year | Within three years: license/registration suspension for one year |

| Iowa | Fine: $500 if in an accident; Otherwise, fine: $250; community service in lieu of fine. Possible citation/warning if pulled over plus removal of plates and registration possible when pulled over without insurance and reissued upon payment of fine or completed community service, proof of insurance, and $15 fee; possible impoundment when pulled over | N/A |

| Kansas | Fine: $300 to $1000 and/or confinement in jail up to six months; license/registration suspension; reinstatement fee: $100 | Fine: $800 to $2500 within three years; license/registration suspension; reinstatement fee: $300 if revoked within previous year, otherwise $100 |

| Kentucky | Fine: $500 to $1000 fine and/or sentenced up to 90 days in jail; license plates and registration revoked for one year or until proof of insurance is shown | Within five years: 180 days in jail and/or $1000 to $2500; license plates and registration revoked for one year or until proof of insurance is shown |

| Louisiana | Fine: $500 to $1000; If in a car accident, fine plus registration revoked and driving privileges suspended for 180 days | N/A |

| Maine | Fine: $100 to $500; suspension of license and registration until proof of insurance | N/A |

| Maryland | Lose license plates and vehicle registration privileges; pay uninsured motorist penalty fees for each lapse of insurance — $150 for the first 30 days, $7 for each day thereafter; Pay a restoration fee of up to $25 for registration | N/A |

| Massachusetts | Fine: $500 to $5000 fine and/or imprisonment for one year or less | Within six years: License/driving privileges suspended for one year |

| Michigan | Fine: $200 to $500 fine and/or imprisonment for one year or less; license suspension for 30 days or until proof of insurance; $25 service fee to Secretary of State | N/A |

| Minnesota | Fine: $200 to $1000 (or community service) and/or imprisonment for up to 90 days; License and registration revoked for no more than 12 months | N/A |

| Mississippi | Fine: $1000; driving privileges suspended for one year or until proof of insurance | N/A |

| Missouri | Four points against driving record; the driver may be supervised; suspended until proof of insurance with $20 reinstatement fee | Four points against driving record; the driver may be supervised; suspended for 90 days with $200 reinstatement fee. |

| Montana | Fine: $250 to $500 fine and/or imprisonment for no more than 10 days | Fine: $350 and/or imprisonment for no more than 10 days — within five years; license and registration revoked until proof of insurance and payment of reinstatement fees within 90 days |

| Nebraska | License and registration suspension; reinstatement fee of $50 for each; proof of insurance to remain on file for three years | |

| Nevada | Fine: $250 to $1,000 depending on the length of lapse; registration suspension — until payment of reinstatement fee and, depending on circumstances, an SR-22 (proof of financial responsibility) if lapsed more than 90 days; reinstatement fee: $250 | Fine: $500 to $1000 depending on the length of lapse; registration suspension — until payment of reinstatement fee and, depending on circumstances, SR-22 (proof of financial responsibility) if lapsed more than 90 days; Reinstatement fee: $500 |

| New Hampshire | Not a mandatory insurance state. Proof of insurance may be required as the result of a conviction, crash involvement, or administrative action. If you are required to file proof of insurance and vehicles are registered in your name, you will be required to file an SR-22 Certificate of Insurance. | N/A |

| New Jersey | Fine: $300 to $1000; license suspension for one year; pay surcharges for three years in the amount of $250 per year | Fine: up to $5000; two-year license suspension; 14-day, mandatory jail term, and an additional mandatory 30 days of community service |

| New Mexico | Fine: up to $300 and/or imprisoned for 90 days; license suspension | N/A |

| New York | Fine: up to $1500 if involved in accident plus $750 civil penalty; license and registration suspension – revoked for one year; suspension of the license if without insurance for 90 days; suspension lasts as long as registration suspension; Suspension of registration: equal to time without insurance or pays $8/day up to thirty days for which financial security was not in effect, $10/day from the thirty-first to the sixtieth day $12/day from the sixtieth to the ninetieth day and proof of security is provided. Or for the same time as the vehicle was operated without insurance. | N/A |

| North Carolina | Fine: $50; registration suspension until proof of financial responsibility but 30-day suspension if in a car accident or knowingly driving without insurance; $50 restoration fee plus license plate fee | Fine: $100 within three years; registration suspension until proof of financial responsibility but 30-day suspension if in a car accident or knowingly driving without insurance; $50 restoration fee plus license plate fee |

| North Dakota | Fine: up to $1500 and/or 30 days in prison; 14 points against license plus suspension; Proof of insurance must be provided for one year; license with a notation requiring that person keep proof of liability insurance on file with the department. The fee for this license is $50, and the fee to remove this notation is $50. | Fine: up to $1500 and/or 30 days in prison; 14 points against license plus suspension; license plates impounded until proof of insurance (provided for one year) plus $20 reinstatement fee; license with a notation requiring that person keep proof of liability insurance on file with the department. The fee for this license is $50 and the fee to remove this notation is $50. |

| Ohio | License/plates/registration suspension until requirements are met, and a $100 reinstatement fee is paid; maintain special high-risk coverage on file with the BMV for three to five years; If involved in an accident without insurance: all above penalties and a security suspension for two years and an indefinite judgment suspension (until all damages are satisfied) | License/plates/registration suspension for one year; $300 reinstatement fee; maintain special high-risk coverage on file with the BMV for three or five years; if involved in an accident without insurance: all above penalties and a security suspension for two years and an indefinite judgment suspension (until all damages are satisfied) |

| Oklahoma | Fine: $250; jail time up to 30 days; license suspension with $275 reinstatement fee. Police can seize license plates and assign temporary plates and liability insurance — in effect for 10 days and can also impound the vehicle. The cost of the temporary coverage is added to the administrative fee and any fines paid for plates to be returned. If the car is impounded, the owner must also pay towing and storage fees. | N/A |

| Oregon | Fine: $130-$1000 ($260 is the presumptive fine); If involved in an accident — at least a one-year license suspension; proof of financial responsibility required for three years | N/A |

| Pennsylvania | Registration suspended for three months (unless lapse was for less than 31 days and the vehicle not operated during that time); $88 restoration fee plus proof of insurance required to get it back; $500 civil penalty fee is optional in lieu of registration suspension plus $88 restoration fee — can only use this option once within a 12-month period | N/A |

| Rhode Island | Fine: $100 to $500; license and registration suspension up to three months; reinstatement fee: $30 to $50 | Fine: $500; license and registration suspension up to six months; reinstatement fee: $30 to $50 |

| South Carolina | Fine: $100-$200 or 30-day imprisonment; failure to surrender registration and plates when insurance lapses; license/registration suspended until proof of insurance plus $200 reinstatement fee | Fine: $200 and/or 30-day imprisonment — within 10 years; license/registration suspended until proof of insurance plus $200 reinstatement fee |

| South Dakota | Fine: $100 and/or 30 days imprisonment; license suspension for 30 days to one year; filing proof of insurance (SR-22) with the state for three years from the date of conviction. Failure to file proof will result in the suspension of vehicle registration, license plates, and driver's license. | N/A |

| Tennessee | Pay $25 coverage failure fee within 30 days of notice; if not paid, then an additional $100 coverage failure fee with suspension or revocation of registration plus reinstatement fee of no more than $25 | N/A |

| Texas | Fine: $175 to $350 fine; plus, pay up to a $250 surcharge every year for three years (may be reduced with certain requirements) | Fine: $350 to $1000; pay up to a $250 surcharge every year for three years (may be reduced with certain requirements); suspend the driver's license and vehicle registrations of the person unless the person files and maintains evidence of financial responsibility with the department until the second anniversary of the date of the subsequent conviction; Impoundment: for 180 days and cannot apply for a release of the car without evidence of financial responsibility and impoundment fee of $15/day. |

| Utah | Fine: $400; license suspension until proof of insurance (maintained for three years) and $100 reinstatement fee | Fine: $1000 — with three years; license suspension until proof of insurance (maintained for three years) and $100 reinstatement fee |

| Vermont | Fine: up to $500; license suspended until proof of insurance | N/A |

| Virginia | Fine: The driver may pay a $500 Uninsured Motorists Vehicle fee to drive without insurance at your own risk. If this fee is not paid in lieu of insurance, all driving and vehicle registration privileges will be suspended until a $500 statutory fee is paid, proof of insurance is filed for three years, and a reinstatement fee (if applicable) is paid | N/A |

| Washington | Fine: Up to $250 or more | N/A |

| West Virginia | Fine: $200 to $5000; license suspended for 30 days with reinstatement fees, unless there's proof of insurance and $200 penalty fee | Fine: $200-$5000 fine and/or 15 days to one year in jail — within five years; license suspended for 90 days and registration revoked until proof of insurance. |

| Wisconsin | Fine: up to $500 | N/A |

| Wyoming | Fine: up to $750 fine and up to six months in jail | N/A |

You will also need your insurance policy handy if you’re calling your insurance company’s 24/7 customer service line. That way you can know that the representative is looking at your policy and that there are no miscommunications.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

If you lose your insurance card, there’s no need to panic. You have multiple options when it comes to recovering your insurance card. These days, many insurance companies allow you to access a digital copy of your insurance card via the company’s mobile app or website.

data-media-max-width=”560″>

If your car is stolen, are you out of luck? Not if you have comprehensive insurance. Want to know more about it? Check out our comprehensive guide: https://t.co/i40h1WzI0u pic.twitter.com/sZJpBKVWNl

— AutoInsurance.org (@AutoInsurance) August 13, 2024

If you prefer a physical copy, you can learn how to get a copy of your auto insurance card by requesting it to be emailed for home printing or sent directly through mail.

While having a digital insurance card is incredibly convenient, you should be sure to keep at least one hard copy in your car’s glove box. With this spare on hand, you can rest assured that you’ll have proof of insurance even if your phone battery were to die. The same rule would apply if you did not have good cell signal or if you’re driving through areas with stricter laws about physical cards.

While being able to provide your own insurance information is very important after being in an accident, it is imperative that you gather the other driver’s information too — especially if they were the ones who caused the accident.

If another driver damaged your vehicle, you’ll need to, at the very least, get the other driver’s:

You should also, if you can, take a picture of the other driver’s insurance card, but if you can’t do that, be sure to clearly write down all the information and safely store it. You will need this information to understand how to file an auto insurance claim with the other driver’s insurance company. Filing such a claim will not affect your insurance history, allowing you to proceed with the necessary repairs.

If you’re thinking about changing insurance companies, you’ll need your old policy reference number to cancel your existing policy. Some companies offer template letters or phone numbers to help with this process and retain your business. State laws guarantee your right to cancel within specific guidelines.

When switching to a new insurer, you receive a new policy insurance number and a temporary card, later replaced by a permanent one. Ensure your new policy starts immediately after the old one ends to avoid coverage gaps. Your policy insurance number can affect your rates; for example, a clean driving record at renewal could qualify you for an accident-free discount.

Below, you can see a list of common car insurance discounts that you could potentially earn when you give your insurance policy number to your insurance representative:

Common Auto Insurance Discounts| Vehicle Discounts | Driver/Customer Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-Lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-Smoker/Non-Drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

As you can probably tell, some of the best discounts come when you exhibit safe driving practices and keep your moving violations to a minimum.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

You need your car insurance reference number to buy auto insurance and to cancel an old policy when switching to a new insurer. This number confirms your coverage and differs between companies. It’s vital to know where to find it for emergencies, traffic stops, or accidents.

Auto insurance laws mandate that every driver has a unique policy number found on documents like bills and insurance cards. It is essential for managing insurance, canceling previous coverage, and making claims, particularly after accidents. Always keep a physical copy of your insurance card, though it is available through your insurer’s mobile app.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

Your auto insurance policy number can typically be found on various documents related to your insurance policy. This may include your insurance ID card, policy declarations page, insurance policy documents, or any correspondence you receive from your insurance company.

An auto insurance policy number is a unique identifier assigned to a policyholder by an insurance company. It is used to look up and manage your policy details, file claims, and verify coverage during traffic stops or accidents.

The auto insurance policy number is important as it allows insurance companies to identify and access specific details about your policy. It is used for various purposes, such as filing claims, making changes to your policy, or communicating with your insurance provider.

Explore our comprehensive resource titled “Filing an Auto Insurance Claim” to deepen your understanding of insurance coverage.

Generally, you cannot change your auto insurance policy number as it is a unique identifier for your policy. However, a new policy number may be issued if you cancel your current policy and then take out a new one.

Yes, auto insurance policy numbers are unique to each policy. This uniqueness ensures that each policyholder’s information and records are individually maintained without mix-ups.

Yes, it is possible to have multiple policy numbers under the same auto insurance company. This can occur if you have multiple vehicles insured with the same company or if you have different types of coverage or policies with them.

Refer to our detailed guide titled “Does a second car affect auto insurance rates?” for a thorough analysis.

The number of digits in an insurance policy number can vary by company. Typically, it ranges from 5 to 10 digits, but it can be longer based on the insurer’s system of numbering.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

No, the policy number and the account number are not the same. The policy number refers to the specific contract of insurance, while the account number may refer to the policyholder’s overall account with the insurance company, which can include multiple policies.

Certain formats of insurance company policy numbers use prefixes or suffixes to denote the type of coverage, providing an auto insurance policy number example where a number could begin with “AU” for auto insurance or “HO” for homeowners, followed by a sequence of digits.

To gain profound insights, consult our extensive guide titled “Does owning a home affect auto insurance rates?” for more details.

If you lose your auto insurance policy number, contact your insurance provider immediately. They can verify your identity and provide you with the policy number. Always keep a backup of your insurance information in a safe place to avoid such issues.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption